Computers, Cameras, or taxes? Section 179 Full Write-Off for Small Businesses

Here in the US, if you’re a small business, you can buy gear for your business and write if off 100% (federal) under Section 179 of the Internal Revenue Code.

Certain limitations apply. Be sure to ask your tax advisor about “section 179" — how about writing off the entire cost of the equipment for 2011, instead of 20% over five years. You have until Dec 31, 2011. State tax laws vary, but here in California, one must still depreciate for state tax purposes.

This accelerated deduction might not be renewed for 2012, so take action now.

Consult your tax advisor here, I am not giving tax advice, just mentioning the topic for your own investigation.

So if you’re planning on buying a Mac Pro or buying a MacBook Pro, now’s the time for this year’s taxes, and check out the MPG Pro Workstation and MPG Pro Laptop upgrade programs too, but don’t wait till after Christmas, too little time to execute.

Ditto for photography equipment.

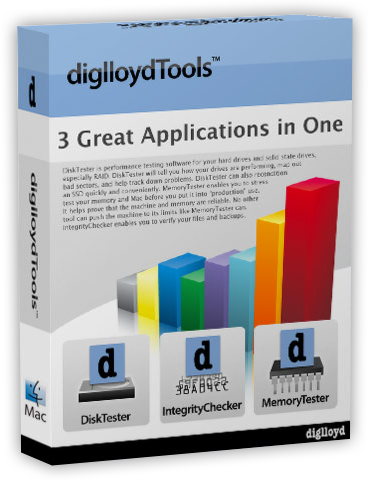

diglloydTools™

diglloydTools™